OUR WORK

Creating Value For our clients

Creating value for real estate investors involves strategies and actions that enhance the profitability and potential of their real estate assets. Dealing with commercial real estate requires a deep understanding of the local market, the property’s potential, and the goals of investors. It’s important to conduct thorough due diligence, financial analysis, and market research before suggesting and implementing any value-enhancing strategy that we think will benefit our clients, regardless if they are sellers or buyers.

Below, you can find a selection of case studies detailing a couple of off-market deals we have recently been involved with and served as the sole broker for all of these transactions.

01

Union City New Jersey 2910 John F. Kennedy Blvd., Union City, NJ 07087

This deal was truly unique, as it involved representing both the seller and the buyer in an off-market transaction. The sellers, who had previously owned multiple car washes, had decided to sell this particular one. I was referred to them by a previous client to provide a price opinion on their property, especially after they had received a wide range of opinions from other agents, varying from $675,000 to $800,000.

We successfully secured a buyer who was specifically seeking strong cash flow. Initially, we estimated the property could sell for $900,000. The existing income was $60,000, based on the previous car wash operator’s rent. This would have valued the property at a 6.6% cap rate at the full asking price. However, we recognized untapped potential, as the current operator was on a month-to-month lease.

Ultimately, we closed the deal at $850,000 and negotiated a tenancy arrangement for the new buyer. This arrangement generated close to $78,000 in net income, resulting in a 9.17% cap rate for the buyer with the added benefit of compounded increases through the long-term lease we secured

02

Industrial Newark two lots, 205 Frelinghuysen Ave Newark, NJ 07114

The complexity of this off-market deal arose not only from the financial figures but also from challenges posed by the owner, tenants, and the poor property condition. The property owner had been attempting to sell this property for over three years. While the property’s valuation was a frequent topic of discussion between the owner and me, his valuation of $2.5 million was significantly inflated and lacked supporting data. Considering the comparable sales in the area and average property values, I calculated that, given the property’s condition, it should have traded between $60 and $75 per square foot.

Additionally, based on income projections of $8 per square foot and factoring in a 40% expense ratio for a 16,000-square-foot property with a 6.6% cap rate assumption, I performed two valuation methods and concluded that the property’s true value should fall within the range of $1 million to $1.2 million. The property is situated within the special development district of Newark Airport and the Frelinghuysen Corridor. Recognizing its potential, I understood that it would hold substantial value for an investor looking to add value or an owner seeking to establish their business headquarters.

Ultimately, I successfully secured a sale price of $1,795,000 for the property, equivalent to approximately $112.18 per square foot – nearly a 40% premium over comparable properties. This outcome left the seller satisfied, while the buyer was enthusiastic about acquiring a property in a specially zoned area, anticipating future rental income following necessary property improvements.

03

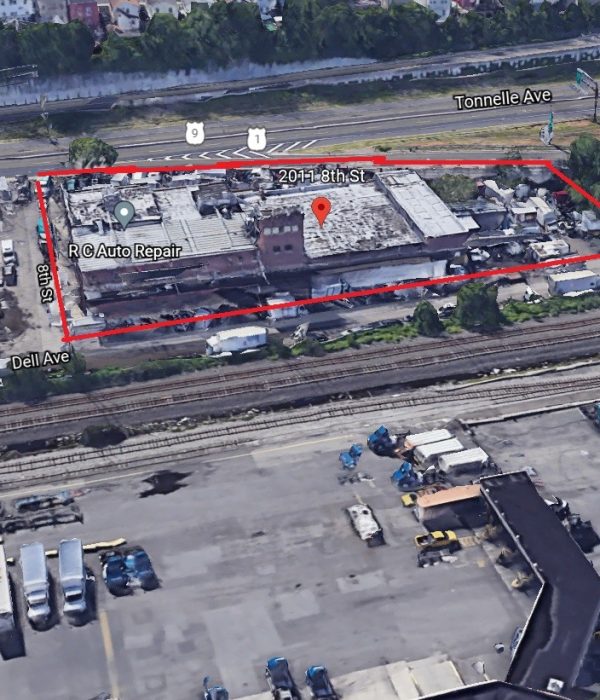

North Bergen Cold storage Value add and Reposition

2011 8th Street, North Bergen, New Jersey, 07047

This deal is by far one of my favorite repositioning and structured transactions, designed to increase the value-add and cash flow of a property using both conventional and unconventional methods to uncover untapped upside potential. The property is a 2.5-story solid brick building with approximately 55,000–60,000 square feet of rentable space, including the cellar floor, which boasts 12- to 14-foot ceilings and a large freight elevator connecting to the loading dock. The majority of the property was owner-occupied, with smaller portions rented to food distributors for dry, cold, and freezer storage. This was an off-market transaction. The property was in below-par condition and loosely managed. The owner’s asking price was over $8 million, which was steep for a Class C warehouse distribution center. Although cold storage commands a premium, the refrigeration system was old and nearing the end of its life expectancy.

Long story short, I secured a buyer at $7.7 million, leaving the seller extremely happy—a solid return, considering they had purchased the building for $700,000 twenty years ago. The buyer was also content and prepared to take on the necessary rehabilitation work. But that wasn’t all: we negotiated a leaseback for 11,000 square feet at a temporary preferential rate of $15 per square foot NNN. Once fully leased, the property is projected to generate an annual cash flow of approximately $825,000, resulting in a 10.7% cap rate.

Now, this is where things get even more interesting. Half of the roof had been leased to a major cell phone carrier for the past 20 years. In discussions with the owner, he often mentioned that this area was a critical network location for cell companies. After conducting further research, I confirmed that the location was indeed highly valuable to cell tower operators. I relayed this information to the buyer, which led to a separate transaction with a group that purchases cell tower cash flows. They sold a permanent easement to half of the roof for $3 million.

With this transaction, the building now effectively sits at $4.7 million, with a projected NOI of approximately $825,000. This repositioned the property from a 10.7% cap rate to a staggering 18.75% cap rate. It’s an exceptional return and a classic example of how looking deeper and identifying hidden value can lead to extraordinary outcomes.

04

North Bergen Industrial Park Value Add - 8555 Tonnelle Avenue North Bergen 07047

The 8555 Industrial Park in North Bergen was another off-market transaction I successfully secured. When I initially spoke with the owner, he was in the middle of negotiating a deal directly with other buyers. In fact, he had attempted to negotiate a sale twice with two separate large groups. I left the conversation by saying, “If you are not successful in selling, let me know—I think I can move it.”

Two months later, he called to inform me that his deals had fallen through and asked what I could do for him. After discussing the details, I realized this property was not suitable for large-scale development, which is what the other two buyers had intended. A large-scale development would require shoring the property—a costly and time-consuming operation that could also involve environmental cleanup. Consequently, this property was best suited for an as-is income-producing investor or a user-owner.

The property consisted of approximately 110,000 square feet of rentable space spread across various units, situated on nearly 4 acres, and was leased to multiple tenants. The current owner had held the property for a long time. Upon reviewing the proforma, I immediately saw the upside potential. During our discussions, I asked him about the price range he had been negotiating with the other buyers. He mentioned it was between $12 million and $13 million. After reviewing the financials, I determined there was enough upside to make the deal attractive to a buyer while also securing a much higher price for the seller than he initially anticipated.

I secured a buyer at $14.35 million, leaving the seller very happy. The buyer acquired a property with month-to-month leases averaging $7 per square foot. We are now repositioning the rents to $16 to $20 per square foot NNN. Once fully leased, this property is projected to generate between a 12.5% return on rental income alone and a 15% cap rate if the outdoor area is rented for fleet parking and storage—an excellent outcome for the buyer. At a stabilized cap rate of 6% to 6.5%, this property will be valued at $25 million to $27 million. There is substantial room to adjust the cap rate to current market trends and eventually cash out with significant value.

Included Coverage:

- First item

- Second Item

- Third item

- Item Four

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Curabitur tincidunt lectus eget magna mattis aliquet.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Integer nisl nisl, ornare tempus odio in, consectetur posuere nisi. Phasellus elit eros, euismod sed scelerisque vitae, condimentum vel orci.

Your Peace of Mind

Aenean sollicitudin, lorem quis biben dum auctor nisi consequat aliquet. Aenean sollicitudin.Proin gravida nibh vel velit auctor aliquet. Aenean sollici tudin, lorem quis bibendum auctor.

Duis ornare finibus purus varius viverra. Sed ut laoreet ante, vestibulum vestibulum nulla. Curabitur ante mauris, sodales ut ex eu, finibus volutpat justo.

Benefits

- Noticing for Fund Trustees in the Upper Tribunal

- Perfect for large company or agency managing.

- Our easy-to-use control panel let you spend

- Suspendisse sit amet ipsum urna.

- Orci varius natoque

Aenean sollicitudin, lorem quis biben dum auctor nisi consequat aliquet. Aenean sollicitudin.Proin gravida nibh vel velit auctor aliquet. Aenean sollici tudin, lorem quis bibendum auctor.

Duis ornare finibus purus varius viverra. Sed ut laoreet ante, vestibulum vestibulum nulla.

Curabitur ante mauris, sodales ut ex eu, finibus volutpat justo.

Address List

- 99-101 Wall Street # 01973, New York, NY 10005

- +1 347 433 5473

- info@connectedrealtygroup.com

Social Networks

- CRG PROPERTIES

- @twitterhandle

- insta_account

- plusprofilename

- username

Links List

Connected Realty Group

New York, New Jersey, Florida, California