Creating value for real estate investors involves strategies and actions that enhance the profitability and potential of their real estate assets. Dealing with commercial real estate requires a deep understanding of the local market, the property’s potential, and the goals of investors. It’s important to conduct thorough due diligence, financial analysis, and market research before suggesting and implementing any value-enhancing strategy that we believe will benefit our clients, whether they are sellers or buyers.

Below, you can find a selection of case studies detailing a few off-market deals I have recently been involved in. I acted as the sole broker for these transactions.

Union City New Jersey 2910 John F. Kennedy Blvd, Union City, NJ 07087

This deal was truly unique, as it involved representing both the seller and the buyer in an off-market transaction. The sellers had previously owned multiple car washes but had made the decision to sell this particular one. I was recommended to them by a previous client to provide a price opinion on their property, especially after they had received a range of opinions from other agents, varying from 675K to 800K.

Ultimately, I managed to close the deal at $850,000 and also negotiated a tenancy arrangement for the new buyer. This arrangement generated close to $78,000 in net income, resulting in a 9.17 cap rate for the buyer with the added benefit of a compounded increase through the long-term lease we signed.

We successfully secured a buyer who was specifically seeking strong cash flow. Initially, I believed the property could be sold for $900,000. The existing income was $60,000, based on the previous car wash operator’s rent. This would have placed the property’s value at a 6.6 cap at the full asking price. However, I recognized that there was untapped potential, given that the current operator was on a month-to-month lease.

Industrial Newark, NJ two Lots

205 Frelinghuysen Ave

Newark, NJ 07114

The complexity of this off-market deal arose not only from the financial aspects but also from the challenges posed by the owner, tenants, and the property’s poor condition. The owner had been trying to sell the property for over three years. While the property’s valuation became a frequent topic of discussion between the owner and me, his asking price of $2.5 million was significantly inflated and unsupported by data. Taking into account comparable properties in the area and average property values, I calculated that, given its condition, the property should have traded for between $60 and $75 per square foot.

Additionally, based on income projections of $8 per square foot and factoring in a 40% expense ratio for the 16,000 sq. ft. property with a 6.6% cap rate assumption, I used two valuation methods and concluded that the property’s true value should fall within the range of $1 million to $1.2 million. The property is located within the special development district of Newark Airport and the Frelinghuysen corridor. Recognizing its potential, I understood that it would hold substantial value for an investor looking to add value or for an owner seeking to establish a business headquarters.

Ultimately, I successfully secured a sale price of $1,795,000 for the property, equivalent to approximately $112.18 per square foot – a nearly 40% premium over comparable properties. This outcome left the seller satisfied, while the buyer was enthusiastic about acquiring a property in a specially zoned area, anticipating future rental income following necessary property improvements.

North Bergen Cold storage Value add and Reposition

2011 8th Street, North Bergen, New Jersey, 07047

This deal is by far one of my favorite repositioning and structured transactions, aimed at increasing value and cash flow for the property, by using both conventional and unconventional methods to uncover untapped potential. The property is a 2.5-story solid brick building with approximately 55,000–60,000 sq. ft. of rentable space, including the cellar floor, which has 12 to 14-foot ceilings and a large freight elevator servicing the loading dock. The majority of the property was owner-occupied, with smaller portions rented to food distributors for dry, cold, and freezer storage. This was an off-market transaction. The property’s condition was subpar, and it was loosely managed. The owner initially sought $8 million, which was high for a Class C warehouse distribution center. Although the property was used for cold storage, which typically commands a premium, the refrigeration system was old and nearing the end of its life expectancy.

Long story short, I managed to secure a buyer at $7.7 million, and the seller was extremely happy—a great return considering he had purchased the building for $700,000 twenty years ago. The buyer was content, knowing they had significant work ahead in rehabbing the building. But that wasn’t all: we negotiated a leaseback of 11,000 sq. ft. at a temporary preferential rate of $15 per square foot NNN. Once fully leased, the property is expected to generate an annual cash flow of approximately $825,000, resulting in nearly a 10.7% cap rate.

Now, this is where things get interesting. Half of the roof had been leased to a major cell phone carrier for the past 20 years. In conversations with the owner, he often mentioned that the cell companies valued this particular location for its network position. After further research, I confirmed that this location was indeed critical for cell tower companies. I relayed this information to the buyer, leading to a transaction with a group that buys cell tower cash flows. We sold a permanent easement to half of the roof for $3 million. As a result, the buyer’s net investment in the building is now $4.4 million, with approximately $825,000 in projected NOI, bringing the property’s cap rate from 10.7% to a staggering 18.75%.

It’s an excellent return and a classic example of how sometimes you need to dig a little deeper to uncover hidden value.

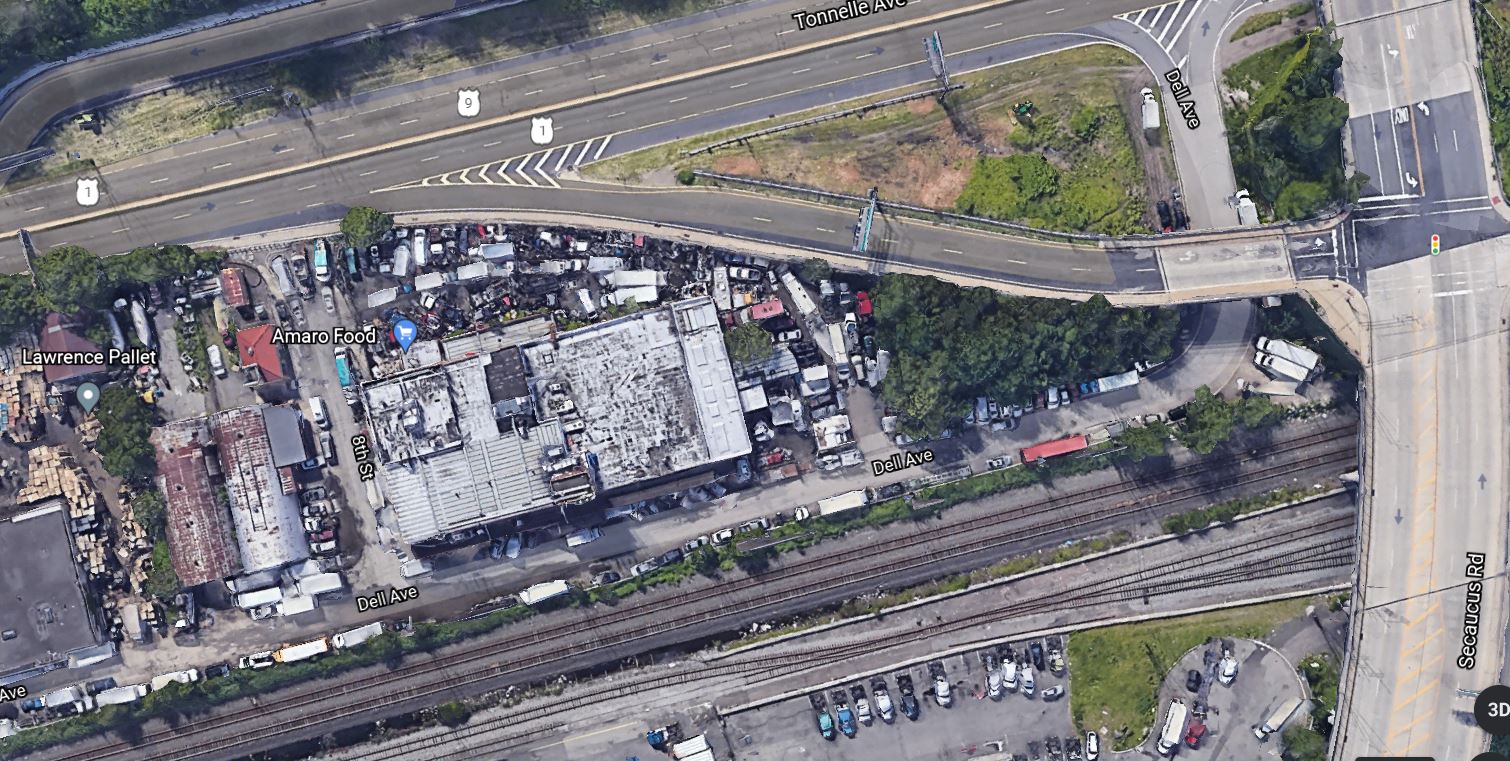

North Bergen Industrial Park Value Add.

8555 Tonnelle Avenue North Bergen 07047

The 8555 Industrial Park in North Bergen was another off-market transaction I secured. When I first spoke with the owner, he was in the middle of negotiating a deal with other buyers he had been dealing with directly. He had actually tried to negotiate a sale twice with two separate large groups. I left it with, “If you’re not successful in selling, let me know. I think I can move it.”

After two months, he called me and told me that both of his deals had fallen through and asked what I could do for him. After we talked, I realized that this property was not suitable for large-scale development. This was what the other two buyers he negotiated with had wanted. A large-scale development would require shoring of the property, a costly and time-consuming operation that could also involve environmental cleanup. Therefore, this property was more appropriate for an “as-is” income-producing investor or a user-owner.

The property was rented to multiple tenants, with a total of approximately 110,000 sq. ft. spread across different sizes, and it sat on almost 4 acres. The current owner had held the property for a long time. I reviewed the proforma and immediately saw the upside. At a few points in our conversation, I asked him about the price range he had discussed with the other buyers. He mentioned it was in the range of $12 to $13 million. After reviewing the proforma, I realized that there was enough upside for the deal to be attractive to a buyer and that I could secure a much higher price for the seller than he had been negotiating.

I secured a buyer at $14.35 million, and the seller was very happy. The buyer acquired a property with month-to-month leases averaging $7 per square foot, which we are now repositioning to $16 to $20 per square foot NNN. When all is said and done, this property will produce between a 12.5% return on rental income alone and a 15% cap rate if the outdoor area is rented for fleet parking and storage. An excellent outcome for the buyer. This property will be valued at $25 to $27 million at a 6% to 6.5% cap rate. There is plenty of room to adjust the cap rate to current market trends and cash out with significant value.

A successful partnership is not just about closing deals but about creating value together.

If you are ready to work with us contact us below